Prepared in compliance with The Investment Advisers Act of 1940 Rule 204-5

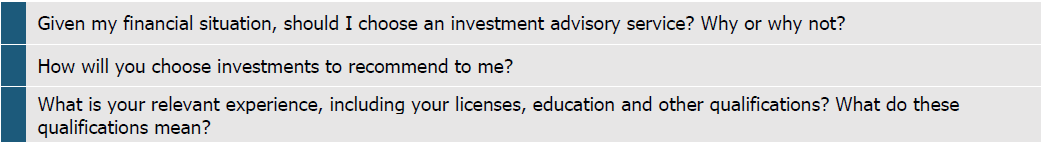

There are different ways you can get help with your investments. You should carefully consider which types of accounts and services are right for you.

Birchwood Financial Partners, Inc. (“Birchwood”, “Firm”, “We”, “Us”, “Our”) is an investment advisor, registered with the Securities and Exchange Commission, and provides advisory services for a fee rather than for brokerage commissions. We are a fiduciary, which means that we are obligated to act in the best interest of our client. As a retail investor, it is important to understand the differences between services and fees of an investment advisor and a broker-dealer. Investor.gov/CRS offers free and simple tools to research firms and financial professionals; it also provides educational materials about broker-dealers, investment advisors, and investing.

We offer the following investment advisory services to you:

Asset Management: We will offer you advice on a regular basis. We will discuss your investment goals, design with you a strategy that attempts to achieve your investment goals, and regularly monitor your account. We will monitor your account on a discretionary basis (we can buy and sell investments in your account without asking you in advance) and/or a non-discretionary basis (you make the ultimate decision regarding the purchase or sale of investments). We do not restrict our advice to limited types of products or investments. This service will continue pursuant to the terms of the executed Advisory Agreement. We have a minimum of $1,000,000 to become a client, although we may make exceptions to this minimum on a case-by-case basis.

We sponsor a wrap fee program, which is for legacy clients only; no new clients are added to the wrap fee program.

If deemed appropriate, we may hire a Sub-Advisor to manage a portion of, or your entire account. In these circumstances, we will continue to monitor the activity of the sub-advisor to ensure it is the best fit for your needs.

Assets Held Away accounts will be monitored on an annual basis, unless requested otherwise by you. Trading in non-discretionary Asset Held Away accounts must be requested by you directly to the custodian on the account.

Financial Planning/Consulting: Services will be provided to you based on your selection on the Advisory Agreement and may include, but are not limited to, a review of investment accounts, including reviewing asset allocation; income taxation; retirement planning; a review of insurance policies and recommendations for changes, if necessary; a written financial plan; estate planning review and recommendations; and education planning with funding recommendations. For stand-alone plans, services will be considered complete upon delivery of the plan.

Additional Information

For more information about our services, we recommend reading our ADV Part 2A Items 4,5,7,10, and if you are in our wrap fee program, Appendix 1 Items 4,5 at info.birchwoodfp.com/adv.

We are paid for our services as follows:

Asset Management: You will be charged an ongoing quarterly fee based on the value of the investments in your account. Our maximum annual fee is 1.50% for investment advisory services. Fees are billed quarterly in advance. Our fees vary and are negotiable. The amount you pay will depend on the amount of assets in your household.

Generally, the more assets you have in your advisory account, the more you will pay us. We therefore have an incentive to increase the assets in your advisory account in order to increase our fees.

Our firm’s fees will be automatically deducted from your advisory account, which will reduce the value of your advisory account. In some cases, our firm will agree to send you invoices rather than automatically deduct our firm’s fees from your advisory account.

Some investments (such as mutual funds and variable annuities) impose additional fees that will reduce the value of your investment over time. Also, with certain investments such as variable annuities, you may have to pay fees such as “surrender charges” to sell the investment. You may also pay a transaction fee to the custodian when we buy or sell an investment for you if you do not participate in our wrap program. You will also pay fees to the custodian that holds your assets (called “custody”). We pay the custodian’s transaction fees for our legacy clients that participate in our wrap fee program. We have an incentive to recommend assets without transaction fees for our wrap service in order to reduce the amount of the custodian’s transaction fees that we will have to pay for participating clients. You pay our advisory fee even if there are no transactions within the account.

Financial Planning/Consulting: We charge a maximum hourly fee of $300 or a fixed fee of between $1,000 and $10,000 for a stand-alone plan/consultation upon delivery of the completed plan/consultation. Ongoing financial planning/consultations with an annual fee of between $1,000 and $25,000 will be payable monthly or quarterly within ten (10) days of receipt of invoice.

Additional Information

You will pay fees and costs whether you make or lose money on your investments. Fees and costs will reduce any amount of money you make on your investments over time. Please make sure you understand what fees and costs you are paying. For more information regarding our fees and costs, review ADV Part 2A Item 5 at info.birchwoodfp.com/adv.

When we act as your investment advisor, we have to act in your best interest and not put our interest ahead of yours. At the same time, the way we make money creates some conflicts with your interests. You should understand and ask us about these conflicts because they can affect the investment advice we provide you. Here is an example to help you understand what this means:

Investment Advisor Representatives of Birchwood do not have any outside business activities that would cause a conflict of interest. However, they do have an incentive to encourage you to increase the assets in your accounts as, generally, the more assets you have in your advisory account, the more you will pay us. For example, if you had funds to either invest or pay off a mortgage or other debt, a conflict arises because we have an incentive to encourage you to invest those funds rather than pay off your debt.

Additional Information

For more information about our conflicts of interest, we recommend reading our ADV Part 2A, Items 5 and 10 at info.birchwoodfp.com/adv.

Our financial services professionals are compensated with a salary, a discretionary bonus or dividends for those professionals that are owners of the firm.

There is a potential conflict of interest because our financial professionals have an incentive to encourage you to increase your assets in your accounts. For more information about our conflicts of interest, we recommend reading our ADV Part 2A, Items 5 and 10 at info.birchwoodfp.com/adv.

No; please visit Investor.gov/CRS for a free and simple search tool to research Birchwood and our financial professionals.

Additional Information

To find additional information about Birchwood, please go to www.Birchwoodfp.com. If you would like to request up-to-date information as well as to request a copy of the relationship summary, please contact us via phone at 952-885-9088.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Birchwood Financial Partners, Inc. and our editorial staff. Material presented is believed to be from reliable sources; however, we make no representations as to its accuracy or completeness. All information and ideas should be discussed in detail with your individual adviser prior to implementation. Advisory services are offered by Birchwood Financial Partners, Inc., an SEC Registered Investment Advisor. Birchwood Financial Partners, Inc. is not affiliated with or endorsed by the Social Security Administration or any government agency, and is not engaged in the practice of law. The presence of this web site shall in no way be construed or interpreted as a solicitation to sell or offer to sell advisory services to any residents of any State other than the States of AZ, CA, FL, IL, MN, NC, NY, TX, WI or where otherwise legally permitted. All written content is for information purposes only. It is not intended to provide any tax or legal advice or provide the basis for any financial decisions.

Images and photographs are included for the sole purpose of visually enhancing the website. None of them are photographs of current or former Clients. They should not be construed as an endorsement or testimonial from any of the persons in the photograph. The inclusion of any link is not an endorsement of any products or services by Birchwood Financial Partners, Inc. All links have been provided only as a convenience.

© 2024 Birchwood Financial Partners. All Rights Reserved.