In an era defined by unprecedented global challenges, the choices we make today hold the power to shape the trajectory of our collective future. Socially Responsible Investing (SRI) has emerged as a beacon of mindful action, where investment decisions bear the potential to forge a path toward a more equitable and sustainable world.

In an era defined by unprecedented global challenges, the choices we make today hold the power to shape the trajectory of our collective future. Socially Responsible Investing (SRI) has emerged as a beacon of mindful action, where investment decisions bear the potential to forge a path toward a more equitable and sustainable world.

In the face of these challenges, the importance of investing in alignment with your ethical principles has never been clearer. Through deliberate SRI choices, you can proactively steer capital towards endeavors that not only yield financial returns but also have the potential to drive positive change.

Socially Responsible Investing is an investment strategy that makes a conscious effort to consider how corporations either have a positive or negative impact on people, communities, and our natural environment.

It’s common to see phrases like environmental, social, and governance (ESG) and impact investing used synonymously with SRI, but these are specific frameworks and strategies that fall under the broader umbrella of SRI.

The ESG framework uses metrics to measure a company's risks outside of a financial accounting lens. It emphasizes environmental, social, and governance as the main criteria for gauging the sustainability of an investment. It does this by selectively including the following ESG data into investment decisions depending on its relevance to the specific company or industry:

These non-financial factors are considered alongside the goals of avoiding undesirable behaviors or reducing portfolio risk. More public and private market funds are incorporating this framework, largely due to investor pressure to do so.(1)

Although creating positive change overall is the goal of SRI, impact investing has a specific focus. Two characteristics of an impact investing approach are intentionality and measurable impact.

I ntentionality: Impact investors actively seek investments that align with their social or environmental goals. They intentionally direct their capital towards companies, organizations, or projects that are making a positive difference in areas such as sustainable development, clean energy, healthcare, education, poverty alleviation, and more.

ntentionality: Impact investors actively seek investments that align with their social or environmental goals. They intentionally direct their capital towards companies, organizations, or projects that are making a positive difference in areas such as sustainable development, clean energy, healthcare, education, poverty alleviation, and more.

Measurable Impact: Impact investing involves measuring and assessing the social or environmental outcomes of investments. These impacts are often quantifiable and can include metrics such as reduced carbon emissions, improved access to healthcare, increased educational attainment, and decreased poverty rates.

SRI is not to be confused with venture philanthropy. Maybe you’ve heard about the super-size gifts from techno-tycoons like Bill Gates or Mark Zuckerberg who donate billions to non-profit organizations or charities. Venture philanthropy is a gifting strategy used by institutional investors that enables those with the means to do more with their donation dollars while minimizing the taxes owed. Stacking charitable deductions, using appreciated assets, donor-advised funds, or giving directly from an IRA are all strategies that venture philanthropy can employ to help a community, see a wrong righted, or give back to a meaningful cause.

SRI uses a different set of strategies because it has a different objective. The goal of SRI at an individual level is to invest your money towards initiatives that align with your values to promote positive change while reaching your financial goals at the same time.

We invest money to make money–that’s a simple fact.

The primary goal of Socially Responsible Investing is to earn market returns, but for some investors, their non-financial goals may also be very important. Can SRI investments meet both goals and remain a viable, competitive option in the marketplace today?

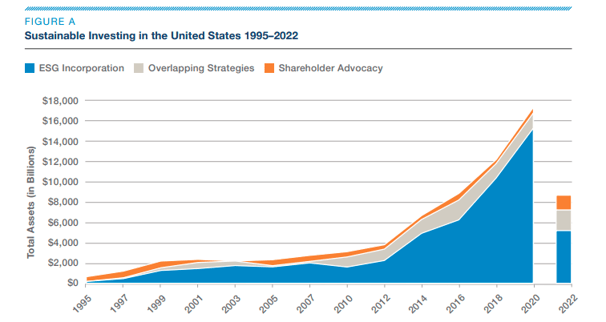

During the last 30 years, the investment industry has seen a boom in the use of SRI strategies, so much so that it’s now become part of global, mainstream investing. Demand for SRI is on the rise as more and more people realize the power they have when aligning their dollars with an organization’s intent.

Source: “Report on US Sustainable, Responsible and Impact Investing Trends”, US|SIF Foundation, 2022

The caveat to this rise in popularity is that investing firms have been able to use buzzwords, specifically around the ESG framework, without backing them up. So much so that the US Sustainable Investment Forum (SIF) changed its reporting methodology for the 2022 SRI Trends report from previous years after finding that assets under management (AUM) of investment professionals and firms “stated that they practice firmwide ESG integration but did not provide information on any specific ESG criteria they used (such as biodiversity, human rights, or tobacco) in their investment decision-making and portfolio construction”.(2)

The positive side is that this interest has multiplied the options available. Unlike 30 years ago, today’s investors may choose from hundreds of SRI mutual funds and exchange-traded funds (ETFs). Nearly all equity asset classes are represented with all U.S. capitalization sizes–i.e., small-cap, mid-cap, and large-cap stocks–plus international and emerging markets.

Offerings within fixed-income securities represent a growing area of SRI investing, allowing investors to finance projects that reduce the environmental impact of an industry. With all of the options available to you, it is important to be careful to choose an investment firm that can back up its claims about SRI/ESG integration, but we’ll go more into that later on.

There is a clear demand for SRI, but how do its investments perform when it comes to meeting the primary goal of earning returns? A growing body of academic research suggests that choosing SRI investments has not had a negative impact on investment performance. In fact, a 2021 review of academic studies conducted by the independent researcher Morningstar found quite the opposite:

Ebbs and Flows Within the Market

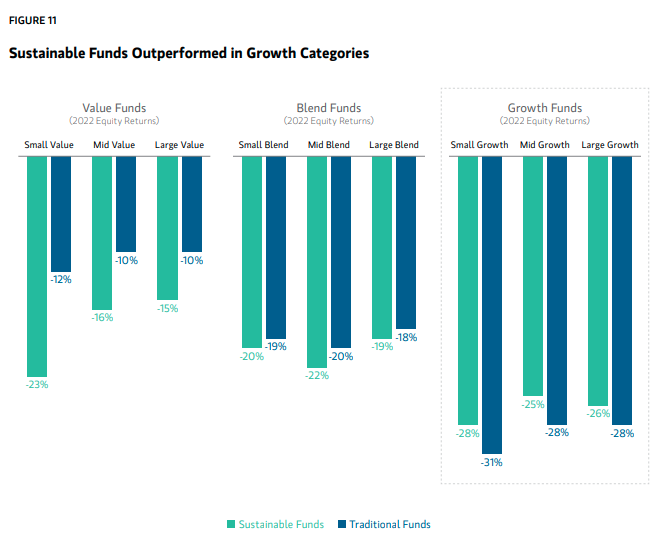

Ebbs and Flows Within the MarketIt is important to note that no investments, including SRI investments, are immune to market shifts. Though there tends to be less downside risk for SRI funds, they are still influenced by the economic environment, which in 2022, was not great for the stock market as a whole.

The rapid rise in interest rates prompted declines in both bonds and equities, a phenomenon not seen in 150 years.(4) The result was a resounding investment shift away from growth funds (which prioritize long-term potential with the understanding that stocks may be more expensive, but with low or no dividend) toward value funds (stocks trading cheaply, often paying relatively higher dividends, and accepting that this may mean comparatively lower growth), and SRI stocks tend to inherently fall under the growth fund category. That said, SRI funds still outperformed traditional funds in the growth category:

Source: “Sustainable Reality: Despite Challenging Market Conditions in 2022, Investor Demand for Sustainable Funds Remains Strong,” Morgan Stanley Institute for Sustainable Investing, 2023.

Source: “Sustainable Reality: Despite Challenging Market Conditions in 2022, Investor Demand for Sustainable Funds Remains Strong,” Morgan Stanley Institute for Sustainable Investing, 2023.

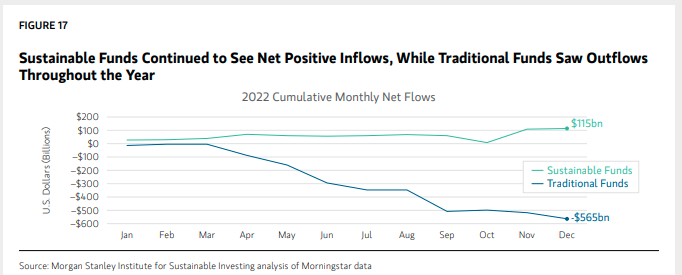

Even with all of the extraneous circumstances, SRI funds still outperformed traditional funds in net positive inflows, which indicates that SRI funds as a whole hold steady, even in an unstable economy.

Source: “Sustainable Reality: Despite Challenging Market Conditions in 2022, Investor Demand for Sustainable Funds Remains Strong,” Morgan Stanley Institute for Sustainable Investing, 2023.

If SRI investments have performed just as well as non-SRI investments, that begs the question, how well has SRI met its non-financial goals? Can your investment choices really make a difference?

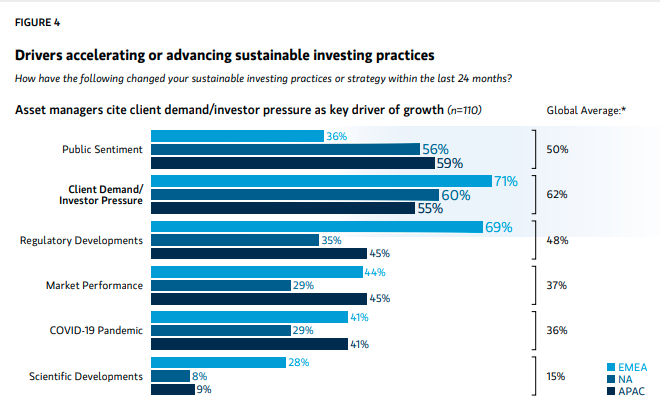

They can when done en masse. Client demand/investor pressure was a major driver in advancing sustainable investing practices for asset managers from 2020 to 2022.(1)

Source: “Sustainable Signals: Opportunities for Asset Managers to Meet Asset Owner Demand”

Source: “Sustainable Signals: Opportunities for Asset Managers to Meet Asset Owner Demand”

Morgan Stanley Institute for Sustainable Investing, 2022

Again, the financial industry has seen a significant influx of money going into SRI investments with 31 percent growth since 2018.(5) This demand is driven in part by the younger generation of investors entering the market. People under 40, Millennials and Gen Z, now make up 46% of all investors in the US, and this demographic is especially passionate about investing in their values; over 8 in 10 Millennial and Gen Z investors reported that they would accept a less than average return on their investment if it was in a company that aligns with their beliefs.(6) Minorities are also far more motivated to invest in the causes they believe in to promote positive social change.(6)

Women are also big supporters of SRI, which is significant given that they are expected to control much of the $30 trillion in financial assets that Boomers currently possess, compared to the $10 trillion (roughly a third) that they currently control, by 2030.(7) This is largely due to the simple fact that women tend to live roughly 5 years longer than their male counterparts, and in heterosexual relationships, many men will cede control of these assets to their female spouses.

These three emerging investor groups–young people, minorities, and women–could soon control a significant portion of the financial assets in the U.S. Imagine the change that could happen if we decided collectively to only invest in companies that were good stewards of the earth, upheld gender equality, promoted diversity and inclusion, and treated their employees and communities well. Companies that don’t follow fair and sustainable practices could lose out on more than half the population of investors, and their stock prices could drop. Investors should not underestimate their power.

There are even more SRI strategies, on top of the ESG framework and impact investing, to consider. The point of choosing SRI strategies is so that you can choose to put your capital toward companies that support your values and address concerns important to you. How well SRI investing achieves these non-financial goals depends on the philosophies and strategies used. Here are the most common.

Negative screening is perhaps the easiest strategy to understand: your values are represented by what you choose not to invest in. Negative screening is the exclusion of sectors or companies involved in activities or industries deemed unacceptable or controversial. Your impact is felt by the dollars you withhold. For example, you might exclude all companies that manufacture, distribute, and sell sporting firearms, weapons, and guns.

Positive or theme investing is the opposite of negative investing in that investments are selected that specifically relate to what is deemed positive or sustainable. For example, you might invest your dollars only in companies that utilize renewable energy, producing no greenhouse gas emissions from fossil fuels. Companies that endorse the CERES Principles (Coalition for Environmentally Responsible Economies) have formalized their dedication to environmental awareness and actively commit to an ongoing process of continuous improvement and systematic public reporting.

Another component of this strategy is to employ gender lens investing. A gender lens incorporates gender-based considerations to accomplish the goals of improved returns, reduced risk, and the promotion of gender equality. It typically means using your capital intentionally to benefit the advancement of women or girls. For example, you might choose to invest in loan programs that support women entrepreneurs in developing countries, or you might want to invest in companies that are working hard on gender equality, have more than one woman on the board, and have equal representation in senior management.

Some people may also choose to screen their potential investments through a racial justice and diversity lens. The overarching mission of race and diversity impact investing is to address and dismantle longstanding disparities and inequities that persist at a systemic level within economic and social structures. At its core, this form of impact investing seeks to channel financial resources toward initiatives that foster racial and ethnic diversity, social inclusion, and equal opportunities.

There is also an aspect of negative screening here related to avoiding companies engaged in sectors and industries that disproportionately impact communities of color.(8) The primary goal is to generate tangible and measurable positive outcomes for underrepresented communities, both in terms of financial returns and broader societal advancement. By investing strategically in businesses, projects, and organizations that prioritize diversity and inclusion, this form of impact investing aims to not only drive economic growth but also dismantle barriers, create pathways for upward mobility, and contribute to a more just and equitable world. Through intentional capital allocation and collaboration, race and diversity impact investing endeavors to amplify the voices and potential of marginalized individuals, fostering meaningful change and creating a more inclusive global economy.

Shareholder advocacy or activist investing focuses on the rights of shareholders to bring about change to a company’s policies and operations. As a shareholder, you become eligible to vote by proxy. Shareholder resolutions and proxy voting are tools used by some funds to influence a company’s decisions to take action on certain issues. Meaning, if large numbers of like-minded individuals purchase shares and/or obtain seats on the company’s board, then change can happen.

Sometimes called faith-based investing (FBI) or faith-based funds, this strategy is generally considered to be the origin of SRI investing. You might think of it as a form of negative investing that screens out companies that engage in activities that are not consistent with a set of religious beliefs. It is also like positive investing in that it includes firms whose activities do not violate the tenets of a given religion.

SRI investments are well represented in the form of mutual funds and ETFs. Both are pooled investments that provide investors with similar goals to benefit from a more diverse set of investments that may lower risk. Mutual funds and ETFs may invest in a number of different securities, such as stocks, bonds, and money market securities.

SRI investments are well represented in the form of mutual funds and ETFs. Both are pooled investments that provide investors with similar goals to benefit from a more diverse set of investments that may lower risk. Mutual funds and ETFs may invest in a number of different securities, such as stocks, bonds, and money market securities.

These are not the only strategies for SRI Investments. What follows are additional strategies and a brief overview to help you understand how they work. These strategies generally require additional due diligence on the part of the investor and may enter into a level of sophistication that is not appropriate for all investors.

Working with a financial advisor can help you navigate the ever-expanding landscape of SRI investments to figure out which strategies can best help you meet your financial and non-financial goals.

Start by asking your advisor these questions:

A fiduciary is required by law to always put your interests ahead of theirs, meaning they must in good faith only recommend products and strategies that are in your best interests.

To figure out what investment strategy will best support your goals, an advisor should take the time to get to know you. This includes an understanding of your values and what’s important to you, as well as what resources and opportunities you have available. In other words, before you invest with an advisor, they should first invest time in getting to know you. Only then can they put together a customized plan capable of helping you reach your goals.

Because SRI investments have more than one goal, we believe the best way to judge performance is to look at how well you are tracking toward the attainment of your specific goals. To measure that usually requires you and your advisor to meet regularly to track progress and take the actions modeled by the plan you’ve outlined together. Your advisor should be able to share information regarding your specific investments and how your assets reflect your values and what’s important to you. If you are uncomfortable with a particular investment, it is important to discuss it with your advisor and, if necessary, request options for replacing that security in your portfolio.

Because SRI investments have more than one goal, we believe the best way to judge performance is to look at how well you are tracking toward the attainment of your specific goals. To measure that usually requires you and your advisor to meet regularly to track progress and take the actions modeled by the plan you’ve outlined together. Your advisor should be able to share information regarding your specific investments and how your assets reflect your values and what’s important to you. If you are uncomfortable with a particular investment, it is important to discuss it with your advisor and, if necessary, request options for replacing that security in your portfolio.

If you choose to build a portfolio of SRI investments on your own, find reputable sources of research on SRI investments. Avoid making an investment based on an advertisement. Remember that you are building a portfolio of investments and you should pay close attention to variables like investment costs, expected risk, correlation of investments, and the quality of the team managing the mutual fund or ETF.

The Pros |

The Cons |

|

|

If you are interested in wielding your financial power, then SRI investing might be right for you. Sustainable, Responsible, Impact investing represents a complex landscape of opportunities that can support your financial goals while representing your values. By strategically aligning your investments with entities that promote environmental or social justice goals and demonstrate good corporate governance, it’s possible to save for retirement and make a positive difference in the world.

If you are interested in wielding your financial power, then SRI investing might be right for you. Sustainable, Responsible, Impact investing represents a complex landscape of opportunities that can support your financial goals while representing your values. By strategically aligning your investments with entities that promote environmental or social justice goals and demonstrate good corporate governance, it’s possible to save for retirement and make a positive difference in the world.

It might take time on your part to do your homework and find the strategy that fits, but everyone with a savings goal needs to learn how to navigate their financial choices. You don’t have to sacrifice investment performance in order to invest responsibly.

SOURCES:

1. “Sustainable Signals: Opportunities for Asset Managers to Meet Asset Owner Demand.” Morgan Stanley Institute for Sustainable Investing, February 2022.

https://www.morganstanley.com/assets/pdfs/CRC-5066630-GSF_Sustainable_Signals_AM_AO_2022_report_FINAL.pdf

2. “Report on US Sustainable, Responsible and Impact Investing Trends.” US|SIF Foundation, 2022. https://www.ussif.org//Files/Trends/2022/Trends%202022%20Executive%20Summary.pdf

3. “Morningstar Indexes' ESG Risk/Return Analysis Reveals Mixed Results for 2021, Good Five-Year Numbers, and Stellar Downside Protection,” Morningstar, February 2022. https://assets.contentstack.io/v3/assets/blt4eb669caa7dc65b2/blt360e4f71e8b5f2a5/6202b9c01586404a56476e96/Morningstar-Indexes-ESG-Risk-Return-Analysis-Reveals-Mixed-Results-for-2021-Good-Five-Year-Numbers-and-Stellar-Downside-Protection.pdf

4. “2023 Global Strategy Outlook.” Morgan Stanley Research, 2023. https://ny.matrix.ms.com/eqr/article/webapp/e02b5a66-4b2b-11ed-a8e6-8e6a277a4f11?ch=rpint&sch=ar

5. “Sustainable Reality: Despite Challenging Market Conditions in 2022, Investor Demand for Sustainable Funds Remains Strong.” Morgan Stanley Institute for Sustainable Investing, February 2023.

https://www.morganstanley.com/content/dam/msdotcom/en/assets/pdfs/Sustainable-Reality_2022_Final_CRC-5440003.pdf

6. “Young Investor Research.” U.S. Bank, May 2023. https://www.usbank.com/dam/documents/pdf/about-us-bank/company-blog/U.S._Bank_Young_Investor_Report_final.pdf

7. “Women as the next wave of growth in US wealth management.” McKinsey & Company, July 2023. https://www.mckinsey.com/industries/financial-services/our-insights/women-as-the-next-wave-of-growth-in-us-wealth-management

8. “Advancing Racial Equity Through Your Investments.” Morgan Stanley Investing With Impact, July 2023. https://www.morganstanley.com/articles/racial-equity-investing-guide

3300 Edinborough Way, Suite 610

Edina, MN 55435

Phone: 952-885-9088

Email: info@birchwoodfp.com

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Birchwood Financial Partners, Inc. and our editorial staff. Material presented is believed to be from reliable sources; however, we make no representations as to its accuracy or completeness. All information and ideas should be discussed in detail with your individual adviser prior to implementation. Advisory services are offered by Birchwood Financial Partners, Inc., an SEC Registered Investment Advisor. Birchwood Financial Partners, Inc. is not affiliated with or endorsed by the Social Security Administration or any government agency, and is not engaged in the practice of law. The presence of this web site shall in no way be construed or interpreted as a solicitation to sell or offer to sell advisory services to any residents of any State other than the States of AZ, CA, FL, IA, IL, MN, OR, TX, WI or where otherwise legally permitted. All written content is for information purposes only. It is not intended to provide any tax or legal advice or provide the basis for any financial decisions.

Images and photographs are included for the sole purpose of visually enhancing the website. None of them are photographs of current or former Clients. They should not be construed as an endorsement or testimonial from any of the persons in the photograph. The inclusion of any link is not an endorsement of any products or services by Birchwood Financial Partners, Inc. All links have been provided only as a convenience.

© 2026 Birchwood Financial Partners. All Rights Reserved.